Digital Branding Strategies

Best 10 Online Platforms for Food and Beverage in the UAE: A Comparative Analysis

Overview

The article identifies the premier online platforms for food and beverage in the UAE, emphasizing their unique features and competitive advantages. It conducts a comparative analysis of platforms including:

- Talabat

- Deliveroo

- Zomato

- Careem NOW

- Uber Eats

demonstrating how their distinct services address diverse consumer needs and preferences. Furthermore, it highlights the projected growth of the market, underscoring the increasing reliance on digital food delivery solutions. This analysis not only showcases the platforms’ offerings but also positions them within the broader context of a rapidly evolving industry.

Introduction

The online food and beverage market in the UAE stands transformed into a bustling arena, brimming with diverse platforms that cater to an ever-evolving consumer landscape. Key players include:

- Talabat

- Deliveroo

- Zomato

- Careem NOW

- Uber Eats

Each platform offers its unique flavor. Talabat boasts an extensive restaurant network and a commitment to local cuisine, while Deliveroo is renowned for premium service and swift delivery. The competition remains fierce. Zomato enhances the dining experience through a blend of food delivery and restaurant reviews, whereas Careem NOW and Uber Eats capitalize on their tech-savvy roots to provide convenience and personalization.

With the demand for online food delivery projected to surge to nearly $1.8 billion by 2033, understanding the strengths and weaknesses of these platforms is essential for consumers aiming to access the best culinary experiences at their fingertips.

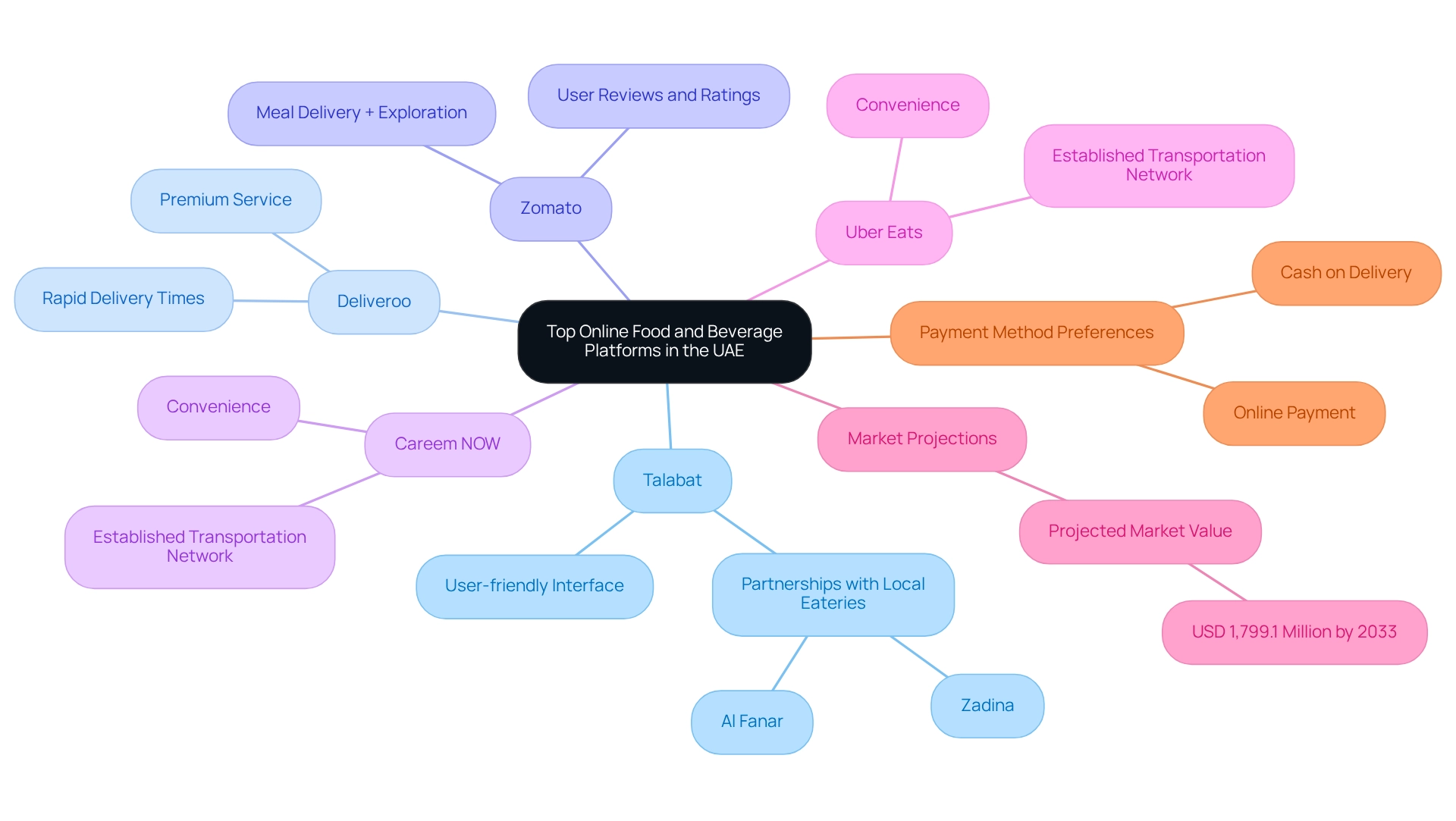

Overview of Top Online Food and Beverage Platforms in the UAE

The competitive online dining and beverage market in the UAE showcases the top 10 platforms catering to diverse consumer preferences. Notable among these platforms are Talabat, Deliveroo, Zomato, Careem NOW, and Uber Eats, each offering unique services that set them apart.

Talabat distinguishes itself with an extensive network of restaurants and a user-friendly interface, making it a preferred choice for many consumers. Importantly, Talabat has forged partnerships with local eateries, such as Al Fanar and Zadina, to provide authentic Emirati dishes, underscoring its commitment to local cuisine. In contrast, Deliveroo is celebrated for its premium service and rapid delivery times, appealing to those who prioritize speed and quality. Zomato enhances user engagement by combining meal delivery with restaurant exploration, featuring reviews and ratings that empower consumers to make informed decisions. Careem NOW and Uber Eats capitalize on their established transportation networks to deliver meals efficiently, targeting tech-savvy consumers who value convenience.

This competitive landscape is further fueled by the increasing demand for the top 10 online platforms for food and beverage in the UAE, projected to reach USD 1,799.1 million by 2033, reflecting a growing reliance on digital platforms for dining options. According to the IMARC Group, the report on this market is comprehensive and data-rich, reinforcing the credibility of these statistics. Moreover, the flexibility in payment options, highlighted in the case study on payment method preferences, attracts a broader clientele, including those less familiar with digital payments. As the market continues to evolve, these platforms are committed to innovation, ensuring they address the dynamic needs of consumers in the region.

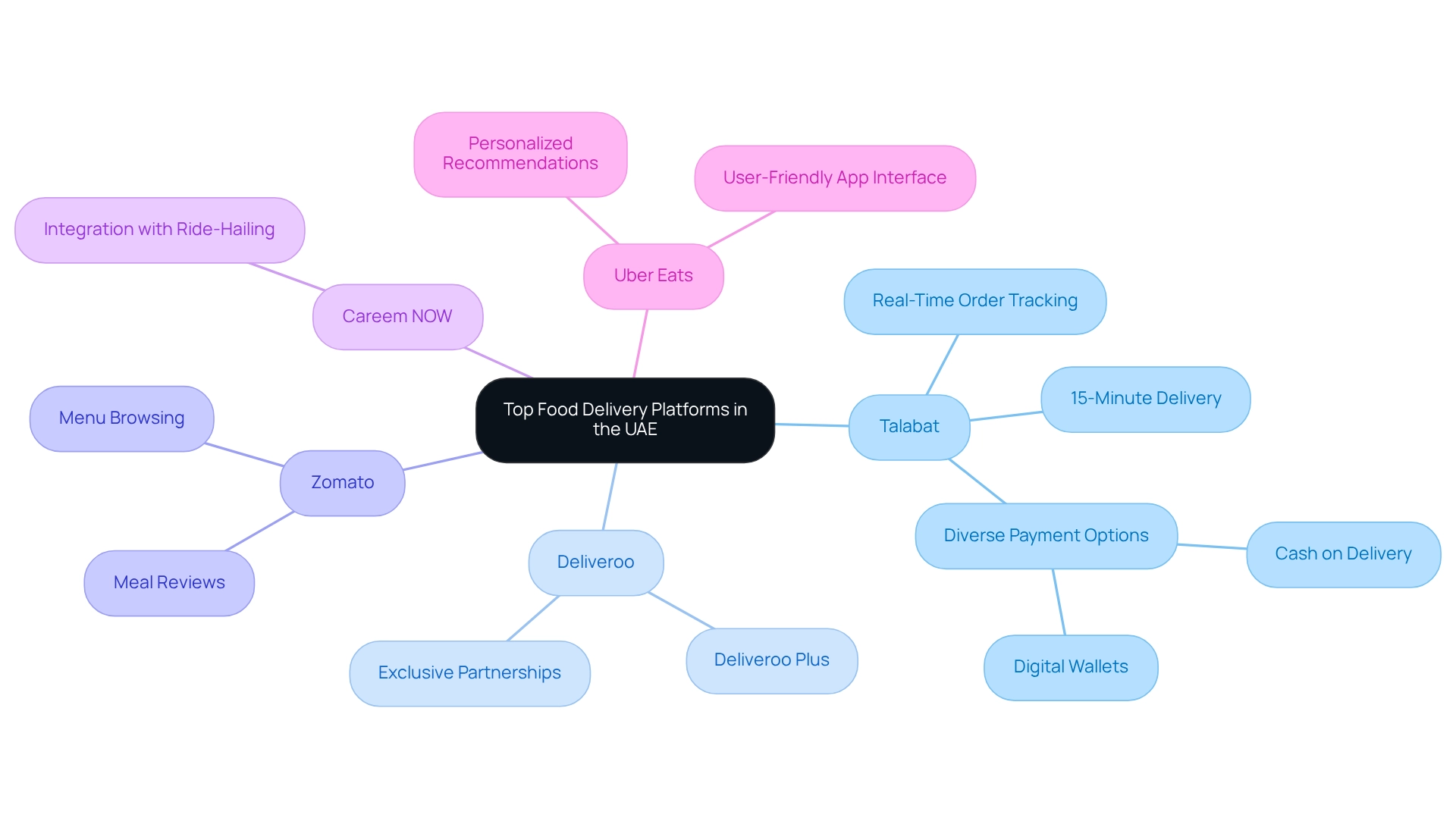

Key Features of Each Platform

Talabat stands out as one of the top 10 online platforms for food and beverage in the UAE, offering an extensive array of eateries, real-time order tracking, and diverse payment options, including cash on delivery and digital wallets, catering to various consumer preferences. Notably, Talabat commits to a 15-minute delivery time within a 3-kilometer radius, underscoring its dedication to service efficiency.

Similarly, Deliveroo is recognized among the best 10 platforms, celebrated for its exceptional service and features like ‘Deliveroo Plus,’ which provides free shipping on orders exceeding a specified amount, along with exclusive partnerships with select eateries, enhancing its appeal to discerning customers. The depth of analysis and accuracy of data within the competitive landscape of meal delivery platforms underscores the importance of such features for informed strategic decision-making.

Zomato, also ranked among the best 10 platforms, uniquely integrates meal delivery with restaurant reviews, enabling users to browse menus and read customer feedback, empowering them to make informed choices prior to placing an order. This synthesis of user-generated content significantly enriches the overall user experience.

Careem NOW exemplifies innovation in food delivery by integrating it with Careem’s ride-hailing services, positioning itself as one of the top 10 platforms in the UAE. This integration allows users to conveniently order food while on the go, highlighting the increasing necessity of such features in today’s competitive market.

Uber Eats is another leading platform, recognized for its personalized recommendations based on previous orders, an extensive selection of dining options, and a user-friendly app interface that ensures a seamless ordering experience. The focus on user experience is paramount, as branding experts emphasize that a well-designed app can greatly impact customer satisfaction and loyalty.

Pros and Cons of Each Platform

-

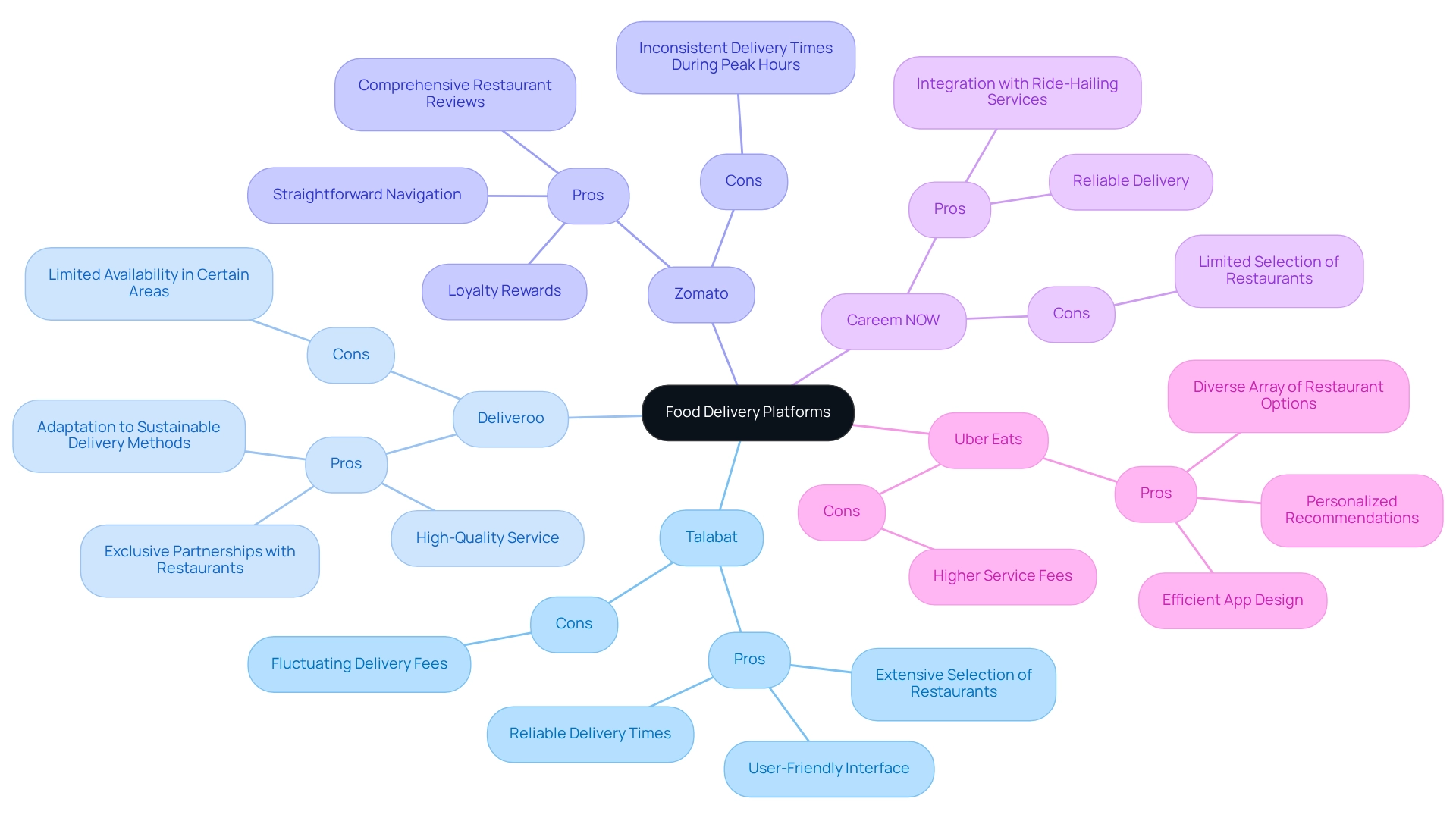

Talabat:

- Pros: Talabat stands out with its extensive selection of restaurants, a user-friendly interface, and reliable delivery times. Positioned strategically within a growing market, it ranks among the top 10 online platforms for food and beverage in the UAE. The food distribution sector in the region is projected to expand significantly, further solidifying Talabat’s market presence.

- Cons: However, delivery fees can fluctuate considerably based on location, potentially impacting customer satisfaction.

-

Deliveroo:

- Pros: Renowned for its high-quality service, Deliveroo boasts exclusive partnerships with popular restaurants and swift delivery times. The platform is also adapting to consumer preferences, particularly the increasing demand for sustainable delivery methods, which are becoming crucial in urban environments.

- Cons: Yet, its availability may be limited in certain areas compared to competitors, which could restrict customer access.

-

Zomato:

- Pros: Zomato excels in providing comprehensive restaurant reviews, straightforward navigation, and loyalty rewards that enhance user engagement. This aligns with the growing consumer demand for transparency and quality in food services.

- Cons: On the downside, delivery times can be inconsistent during peak hours, leading to potential customer frustration.

-

Careem NOW:

- Pros: Careem NOW conveniently integrates with ride-hailing services, ensuring reliable delivery. This integration reflects a broader market trend toward multi-service platforms, enhancing user convenience.

- Cons: Nevertheless, it offers a more limited selection of restaurants compared to larger competitors, which may not fulfill all customer needs.

-

Uber Eats:

- Pros: Uber Eats features personalized recommendations, a diverse array of restaurant options, and an efficient app design that significantly enhances user experience. The platform’s focus on user experience is vital, especially as the meal transportation market is expected to reach $2.18 billion in Singapore by 2029, indicating substantial growth potential in the region.

- Cons: Conversely, service fees are generally higher than those of some local platforms, which could deter price-sensitive customers. By integrating perspectives from industry analysts, one can gain a deeper understanding of the strengths and weaknesses of the top 10 online platforms for food and beverage in the UAE, providing a comprehensive view of the meal distribution landscape.

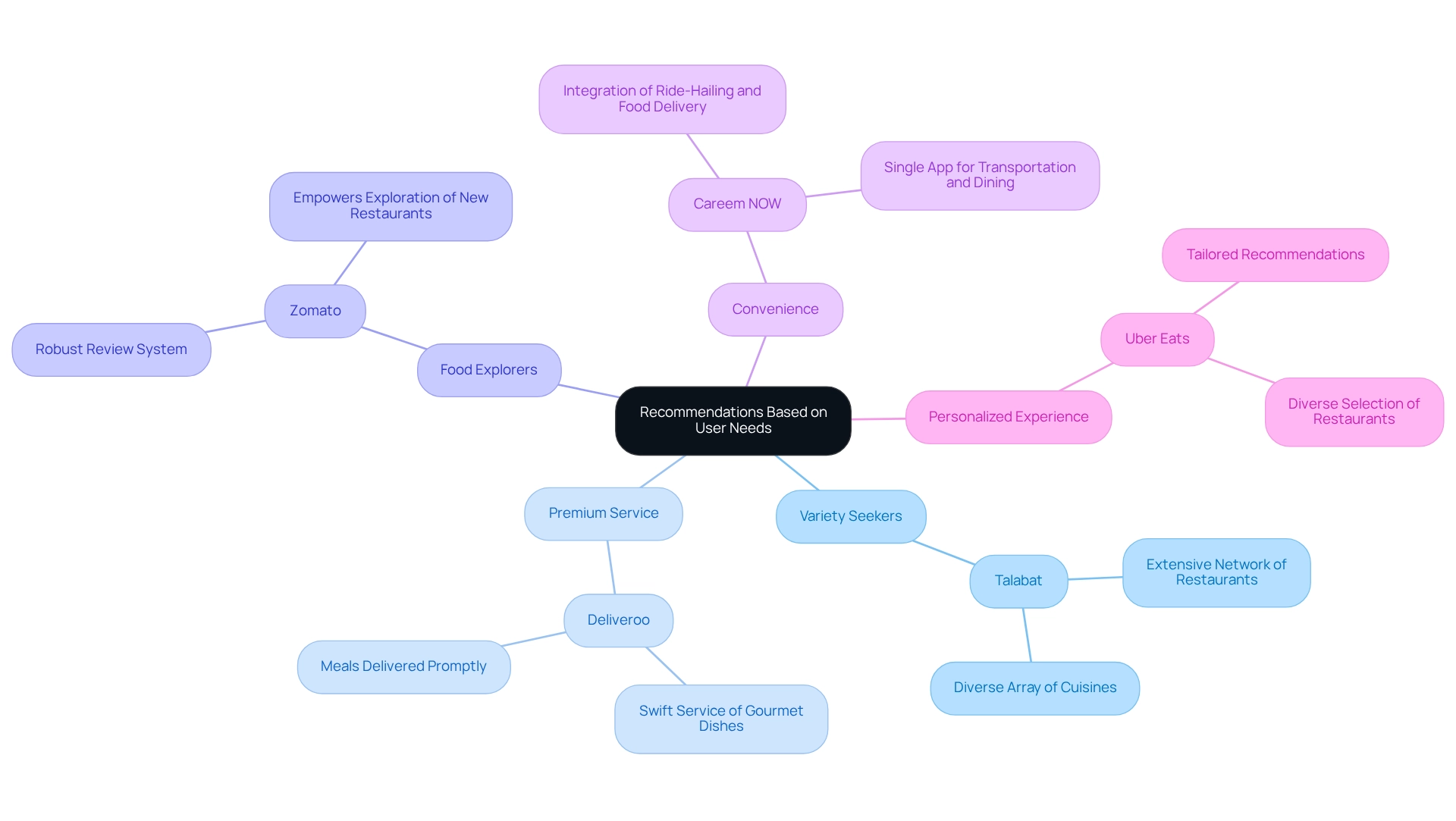

Recommendations Based on User Needs

- For Variety Seekers: Talabat distinguishes itself with an extensive network of restaurants, presenting a diverse array of cuisines that cater to various tastes. This platform is particularly favored for its capacity to satisfy the cravings of those seeking variety.

- For Premium Service: Deliveroo emerges as the preferred choice for consumers who prioritize quality and speed in their food transportation experience. Renowned for its swift service of gourmet dishes, it guarantees that patrons receive their meals promptly and in superb condition. As Tarun Nagar notes, “Deliveroo is particularly adept in rapidly delivering fine dining cuisine.”

- For Food Explorers: Zomato is the ideal platform for users who relish discovering new dining experiences. With its robust review system, it empowers patrons to explore new restaurants and make informed choices before placing their orders.

- For Convenience: Careem NOW presents a seamless solution for users who wish to integrate ride-hailing with food delivery. This integration simplifies the process, enabling users to manage their transportation and dining needs within a single app.

- For Personalized Experience: Uber Eats excels in delivering tailored recommendations based on user preferences. Its diverse selection of restaurants ensures that diners can find precisely what they desire, enhancing their overall dining experience.

In the context of the rapidly expanding meal distribution market in the region, projected to reach USD 12,977.6 million by 2030 in Saudi Arabia, the leading 10 online platforms for food and beverage in the UAE are increasingly adopting strategies such as discounts, promo codes, and loyalty programs to attract and retain customers. A notable example is Snoonu, a meal transportation application established in Qatar, which has effectively penetrated the UAE market by offering fast service from supermarkets and eateries, along with real-time tracking and secure online payments. This competitive positioning underscores the necessity of understanding user needs and preferences in the evolving food delivery landscape.

Conclusion

The online food and beverage market in the UAE presents a dynamic and competitive landscape, prominently featuring key players such as:

- Talabat

- Deliveroo

- Zomato

- Careem NOW

- Uber Eats

Each platform is distinguished by unique features designed to cater to diverse consumer preferences. Talabat stands out with its extensive restaurant network and commitment to local cuisine, while Deliveroo is recognized for its premium service and rapid delivery. Zomato enhances user engagement through its comprehensive restaurant reviews, and both Careem NOW and Uber Eats leverage advanced technology to provide convenience and personalization.

As the demand for online food delivery continues to surge, projected to reach nearly $1.8 billion by 2033, understanding the strengths and weaknesses of these platforms becomes increasingly vital for consumers. Each service offers its own set of advantages and disadvantages, enabling users to select the option that best aligns with their specific needs—be it variety, premium service, or convenience.

Navigating the vibrant online food delivery landscape in the UAE necessitates that consumers carefully consider their priorities. By recognizing the unique offerings of each platform, users can optimize their culinary experiences, ensuring they enjoy the best the market has to offer. As competition intensifies, innovations will continue to emerge, further enriching the choices available to consumers and enhancing the overall dining experience in this bustling market.

Frequently Asked Questions

What are the top online dining and beverage platforms in the UAE?

The top platforms include Talabat, Deliveroo, Zomato, Careem NOW, and Uber Eats, each catering to diverse consumer preferences.

How does Talabat differentiate itself from other platforms?

Talabat is known for its extensive network of restaurants and user-friendly interface. It also partners with local eateries to offer authentic Emirati dishes.

What makes Deliveroo a popular choice among consumers?

Deliveroo is celebrated for its premium service and rapid delivery times, appealing to customers who prioritize speed and quality.

How does Zomato enhance user engagement?

Zomato combines meal delivery with restaurant exploration, featuring reviews and ratings that help consumers make informed decisions.

What advantages do Careem NOW and Uber Eats offer?

Careem NOW and Uber Eats leverage their established transportation networks to deliver meals efficiently, targeting tech-savvy consumers who value convenience.

What is the projected market value for online food and beverage platforms in the UAE by 2033?

The market is projected to reach USD 1,799.1 million by 2033, reflecting a growing reliance on digital platforms for dining options.

How does the flexibility in payment options affect consumer engagement?

The flexibility in payment options attracts a broader clientele, including those less familiar with digital payments, enhancing overall consumer engagement.

What is the significance of the IMARC Group report mentioned in the article?

The IMARC Group report provides comprehensive and data-rich insights into the online food delivery market, reinforcing the credibility of the statistics presented.

How are the platforms adapting to the evolving market?

The platforms are committed to innovation, ensuring they address the dynamic needs of consumers in the region as the market continues to evolve.